Fraudsters claim millions of the public's hard-earned cash each year. In the past year alone, UK police have dealt with over 310,000 reports of fraud, resulting in the loss of more than £2 billion of consumers’ money, an increase of £20 million from the year before (Dec 2021-Jan 2022). Online shopping and auction, advance fee, cheque, card and online bank account scams are just a few fraud schemes hitting consumers the hardest.

With the cost of living crisis leaving many people more financially vulnerable, and therefore more susceptible to financial help scams, the rise of fraudsters is becoming ever more dangerous. To find out who has been most affected, Fluro has researched which regions of the UK see the most reports of fraud, which types of fraud cost consumers the most money, and which types of scams are the most commonly reported.

The UK’s Fraud Hotspots

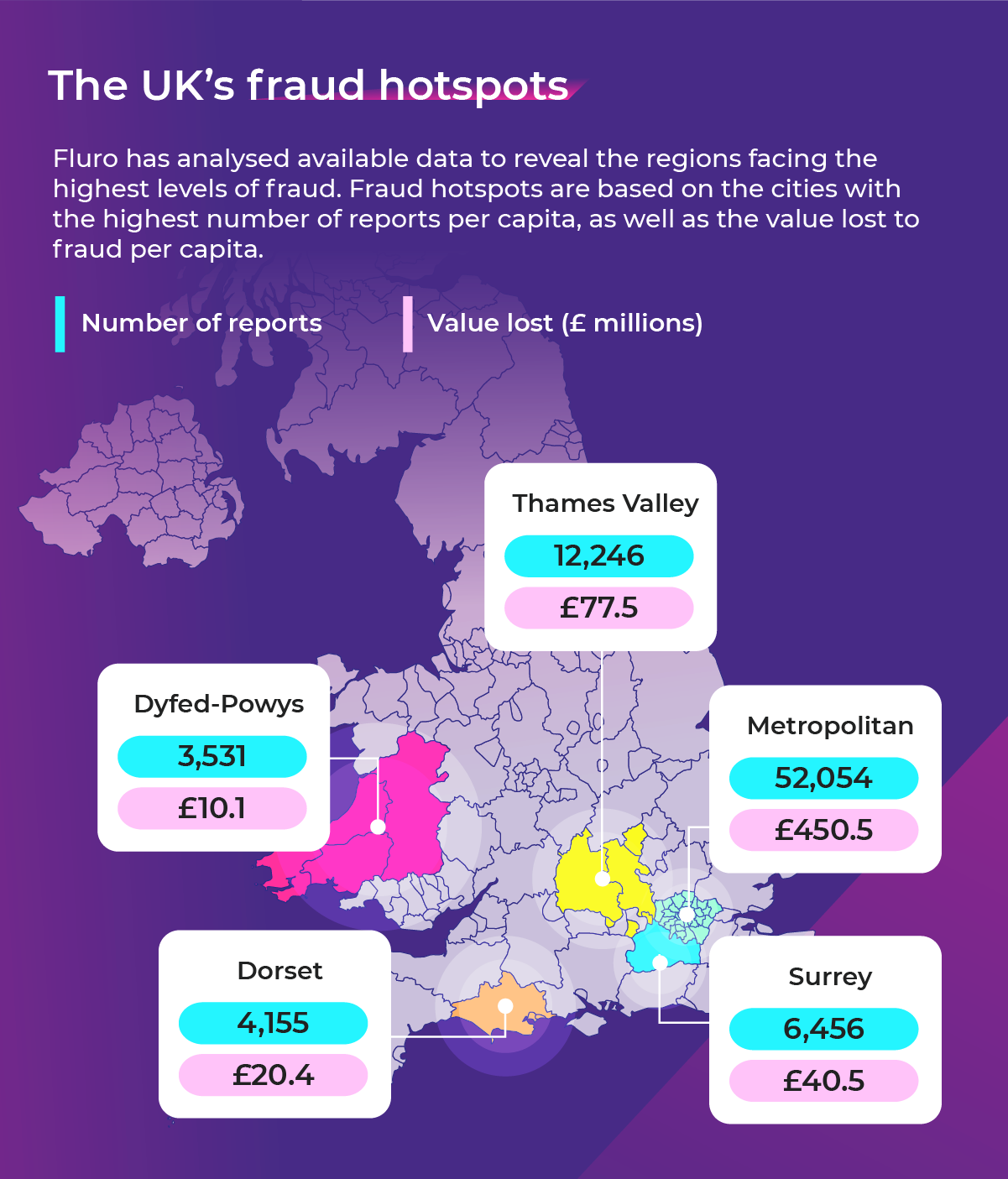

To find out the UK’s fraud hotspots we looked at the UK’s 49 police forces, analysing the number of fraud instances reported per region alongside the value reported lost, forming a ranking of the locations most affected by fraud.

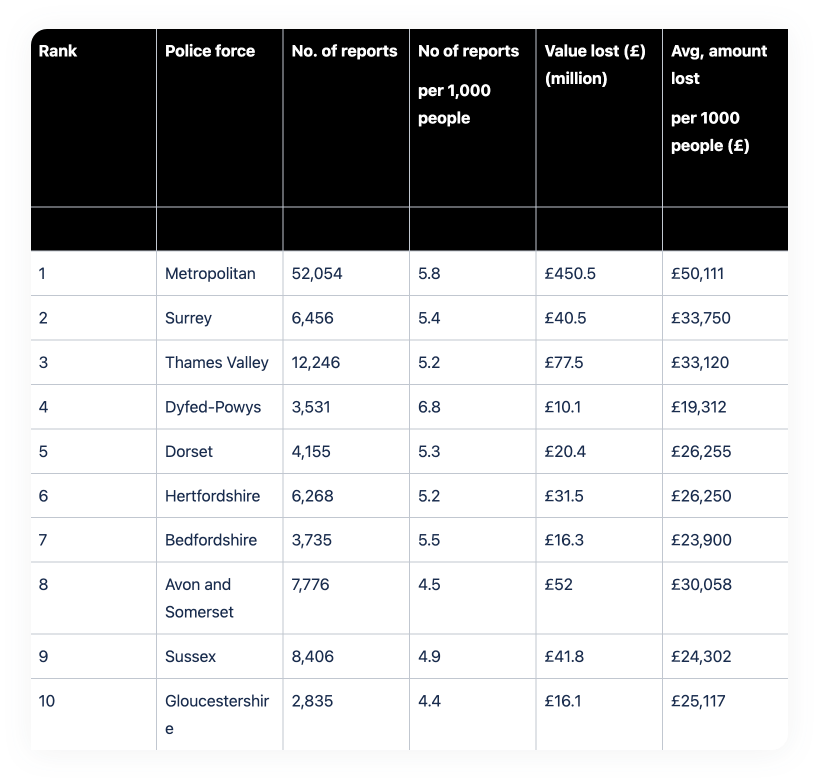

The top 10 UK areas most affected by fraud

According to our analysis, the area covered by the Metropolitan Police force (London region excluding City of London) sees the highest number of reports (around six reports per 1,000 residents) and the highest average amount lost to fraud (£50,111 lost per 1,000 residents), ranking London highest overall in our UK fraud hotspot index.

Our study reveals Surrey as the second largest fraud hotspot in the UK, with 6,456 reports of fraud made here in just one year, with the estimated value lost to fraud by Surrey residents in the last year standing at around £40.5 million. The third largest fraud hotspot region was covered by Thames Valley police force, including Buckinghamshire, Oxfordshire, Milton Keynes, and Reading (amongst others), here fraud losses amounted to £77.5 million.

Meanwhile, Dyfed-Powys police force ranks fourth, which covers the areas Carmarthenshire, Ceredigion, Pembrokeshire, and Powys, seeing the highest number of fraud reports per person with just under seven fraud reports made on average per 1,000 people (3,531 reports made from a population of around 523,000).

As part of our study into rising fraud in the UK, we not only looked at instances per region but delved into the frequency of types of fraud and their impact to get a larger picture of the current fraud landscape.

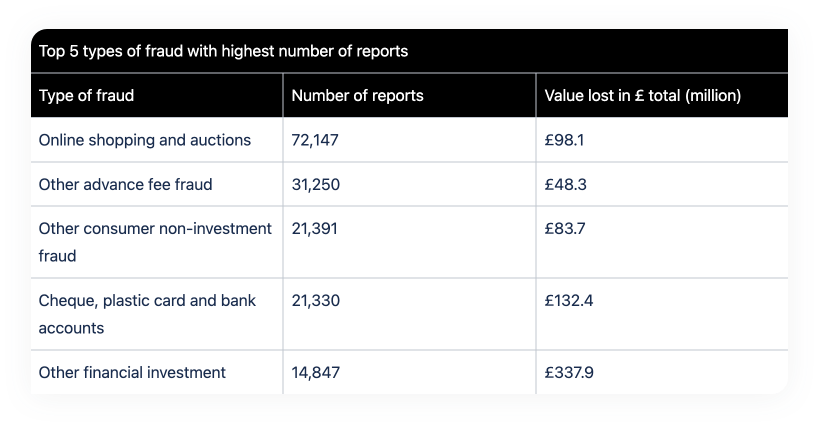

Top five types of fraud with the highest number of reports in the UK

There are a number of reasons why fraud cases go unreported; the victim may feel embarrassed that they’ve been tricked, be unsure about who to report it to, or feel uncertain that what has happened to them is actually a crime. Of the cases that are reported, we looked into which types are reported the most.

Online shopping and auction scams are the most commonly reported. Over a period of just 12 months, £537.7 million was lost to fraudsters as a result of 72,147 incidents. Advance fee fraud (31,250), consumer non-investment fraud (21,391), and cheque, plastic card, and bank account fraud (21,330) follow as the next most reported types.

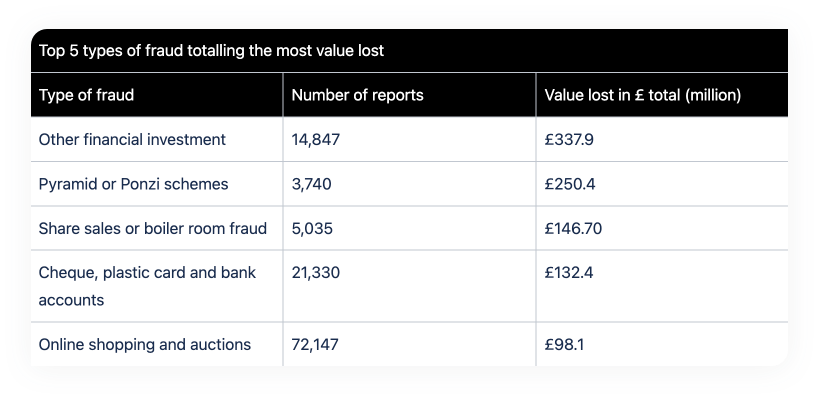

The most expensive types of fraud for consumers in the UK

Aside from fraud cases that could not be categorised, financial investment schemes are responsible for the biggest cash loss in total. In just one year there were 14,847 reports of financial investment fraud in the UK, in which the public lost a total of £337.9 million. Pyramid and Ponzi schemes are the next most costly type of fraud on a nationwide scale, with 3,740 cases leading to a total loss of £250.4 million.

Share sales/boiler room fraud round off the top three most expensive types of fraud. These types of scams involve fraudsters cold-calling investors to offer them worthless, overpriced, or even non-existent shares or bonds using high-pressure sales tactics.

How does fraud affect businesses in the UK?

Although our focus is mostly on how fraud affects consumers, businesses big and small are also targeted by criminals, and experience substantial losses as a result. Over a 12-month period, businesses in the UK were defrauded out of £2.2 billion across 37,662 cases.

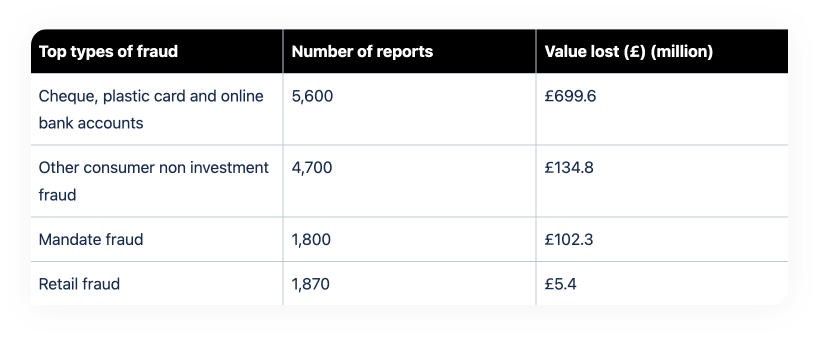

Cheque, plastic card and online bank accounts, other consumer non-investment fraud, mandate fraud, and retail fraud are the main categories of fraud reported by British companies. These types of fraud alone have cost companies £942.1 million in the past year, and have been reported 13,970 times.

Which scams are on the rise?

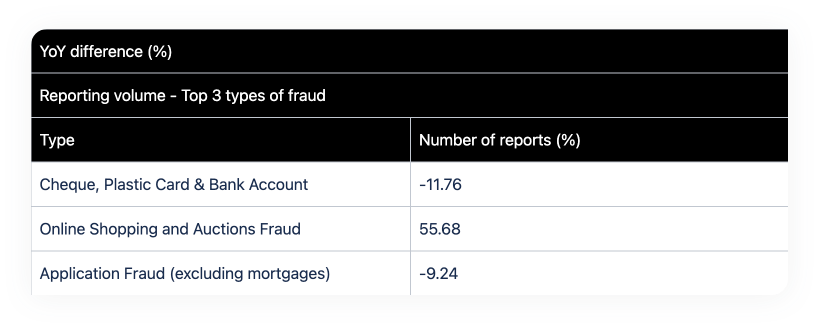

Over the past 12 months, the total number of fraud reports (individual and organisational) made to Action Fraud, Cifas, and UK Finance rose by 6.49%, resulting in an increase in loss of £20 million. Action Fraud saw the biggest YoY reporting increase, receiving 26.76% more reports while the number received by Cifas dropped by 12.3%.

Although cheque, plastic card and bank account fraud is the most commonly reported kind of fraud, the number of reports received by the UK’s fraud centres decreased by almost 12% YoY (11.76%). Conversely, the second most reported type of fraud, online shopping and auction fraud, rose by 55.68% - which might be a sign that scammers are using increasingly sophisticated schemes and a warning sign that shoppers need to take extra care when paying for goods and services online.

The UK banks being targeted most in bank scams

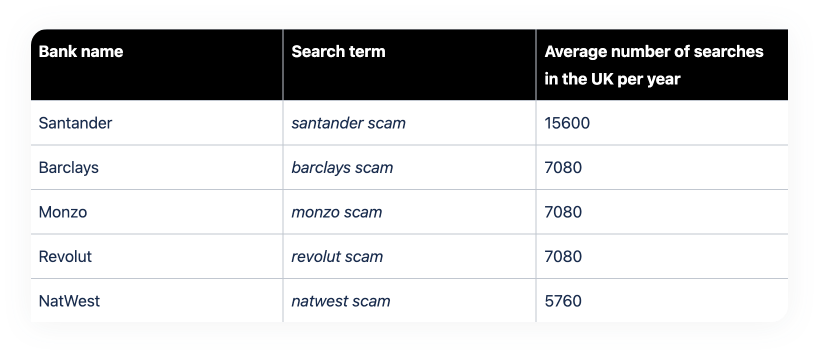

Scammers often pose as different banks in order to gain access to your accounts and convince you to send them money. Looking at the UK search volume for different banks followed by the term ‘scam’, our study has revealed which banks scammers are likely posing as the most:

Out of the 40 UK banks we looked into, ‘Santander scam’ was searched the most by far, with an average of 15,600 yearly searches. With an average of 7,080 yearly searches, Barclays, Monzo, and Revolut ‘scams’ are all joint with the second highest search volume. Natwest impersonators have led to an average of 5,760 yearly searches for ‘natwest scam’, making them the fifth most popular bank for scammers to target.

With the number of reported fraud cases increasing by 6.49% YoY and the nation losing more than £2 billion to fraudsters in the past 12 months alone, it’s more important than ever that consumers take extra precautions against fraudsters.

Things to look out for

Knowing that the cost of living crisis can make people more vulnerable to scams Nicholas Harding, Founder and CEO at Fluro, wants to make sure that UK consumers know “Fraudsters are constantly inventing new ways to trick people, which is why it’s crucial that individuals stay up to date on the latest best practices for preventing scams. Here are a few actions you can take to help keep your money safe;

- Don’t give out your bank details or personal information, including pins and passwords to anyone you don’t know and trust.

- When online, don’t click on links in emails, pop-ups or ads. If you receive an unexpected email or text from your bank, remember that they will never ask you to confirm your details by clicking a link - even if it might look genuine, fake email addresses and phone numbers can be made to mimic the official ones.

- Scammers will pretend to be from an organisation you know, they may even be able to call from the number of a legitimate company but that does not mean it is them. If they consistently tell you to check the number they’re calling from as proof it’s legitimate, it’s likely to be a scam. Always hang up and place a call yourself to a known-safe number.

- If an offer seems too good to be true, make sure you question the deal and do research before continuing. Scammers will pressure you to act immediately - always ask for time before agreeing to any deal or signing any contract.”

- Things your bank will never do:

- Transfer money to a "safe account".

- Your bank will never call you and request your OTP (one time passcode) to authorise payments.

- Or set up a new payee

- Or register a device for online banking

- Your bank will never ask you to reveal your PIN or password for online banking

- Always check large credits into your bank account and be wary of references such as "loan". Always contact the organisation it came from directly if you are suspicious.

What to do if you think you’ve been scammed

Our research shows that many of us still, unfortunately, fall victim to fraud despite our best efforts to avoid being targeted. If you suspect you’ve been scammed, here’s what you need to do.

- Report it - If you think you’ve been a victim of fraud, you need to report it as soon as possible. You can use Action Fraud’s online reporting tool or call them on 0300 123 2040. If the suspected fraud involves your credit or debit card, online banking, or a cheque, contact your bank or credit card company immediately.

- Call the police if you’re in danger - If there is a crime being committed or you are in danger, call the police on 999.

- Get free confidential support from Victim Support - When you report fraud to Action Fraud, you have the option for your contact details to be passed on to Victim Support. They can provide you with free, confidential emotional support and practical help.

- Staying in the know and up to date with common types of fraud will help you outsmart any scammers and keep your finances safe.

Methodology

Most popular/costliest types of fraud for consumers - To get the results for this section of our analysis, we used NFIB Dashboard going through each type of fraud listed (crime by code) to see how many reports there have been in the past 13 months - per type of fraud and the reported losses. Filters: "Individual"-toggle enabled and "Fraud"-toggle enabled.

UK Fraud hotspots were found by filtering by each regional police force to find the total reports and losses. These were then scored and ranked by the highest average reports per capita and losses per capita.

Organisational fraud - Toggle was changed from “Individual” to “Organisational” to find out the top types of fraud companies in the UK are facing.

Scams on the rise - We used previous year data (2019-20 and 2020-21) compared to the past 13 months to see if there has been a significant rise in certain types of fraud.

UK banks being targeted most in bank scams (search volume data) - Using 'bank name scam' as a search term, we used Google Keyword Planner to find the number of searches in the UK for this result. Banks included were from a seed list of top 40 banks in the UK.

‘None of the Above’ fraud category was removed from rankings for clarity as this will include numerous unconfirmed types of fraud.

Sources

List of police forces in the UK

ArcGIS Dashboards

Estimates of the population for the UK, England, Wales, Scotland and Northern Ireland - Office for National Statistics

https://www.nrscotland.gov.uk/statistics-and-data/statistics/statistics-by-theme/population/population-estimates/mid-year-population-estimates/mid-2021#

https://www.nisra.gov.uk/statistics/population/mid-year-population-estimates

https://www.gov.je/Government/JerseyInFigures/Population/pages/populationstatistics.aspx

https://www.justiceinspectorates.gov.uk/hmicfrs/police-forces/thames-valley/

The most popular consumer banks in the UK | Economy | YouGov Ratings